Business Finance with Procuret

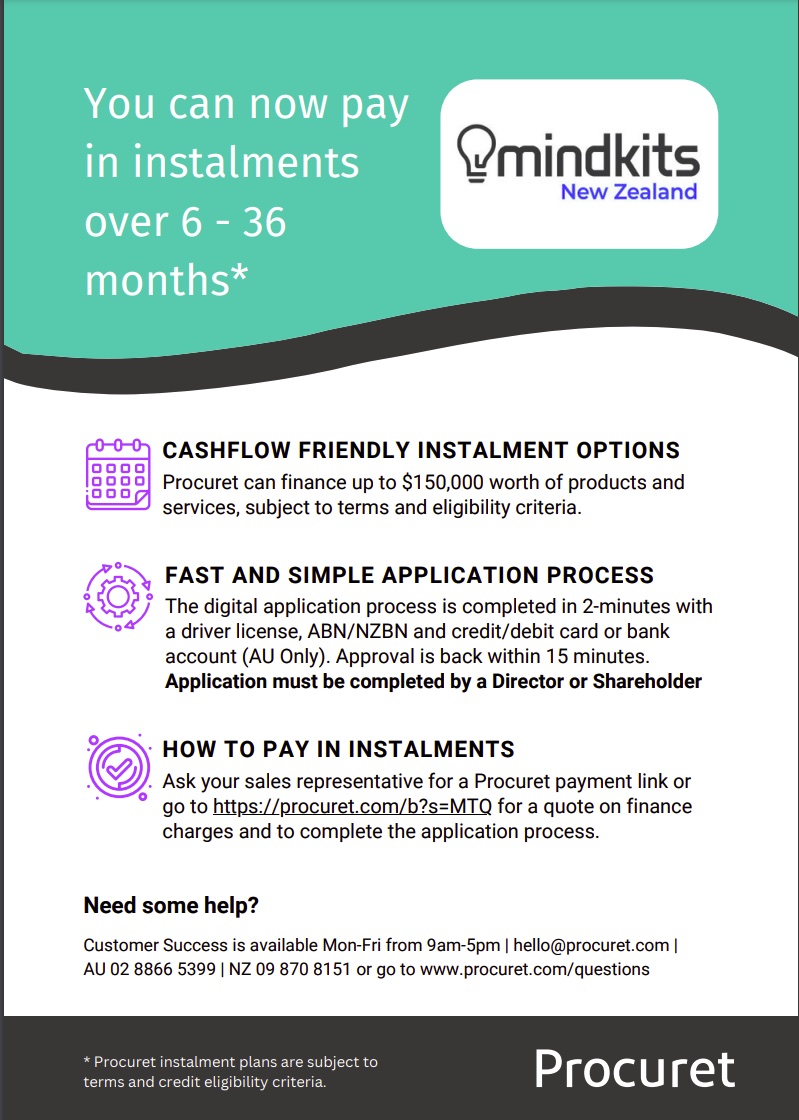

MindKits is now offering business finance options on products over $500 through Procuret

Procuret offers your business a quick and flexible finance solution to acquire the equipment you need now.

They are experts in the equipment finance space and can provide tailored options that best suit your company needs.

Split Payments Over Months or Years

This solution is best suited for equipment that retains value over a longer life-span

Benefits of Financing Equipment

Ownership of the Asset

Ownership of the equipment automatically transfers to your business at the end of the Rent-to-Own term.

Conserve your cash

Keep your company’s cash in your business and working for your business!

Minimal Upfront Costs

Allow your business the ability to spread the cost of the equipment over much easier to manage monthly instalments.

The Rent-To-Own term can range from months to years.

Tax Deductibility

GST is required to be paid upfront and can thus be claimed back almost immediately.

Your equipment is treated as an asset on your company’s balance sheet with interest and depreciation typically claimable as a tax-deductible expense (please obtain independent accounting and tax advice).